All Categories

Featured

An investment vehicle, such as a fund, would certainly need to establish that you qualify as a recognized capitalist - finra accredited investor. To do this, they would certainly ask you to submit a set of questions and perhaps give certain papers, such as financial declarations, credit report reports. new rules for accredited investors, or income tax return. The benefits of being a recognized financier consist of access to one-of-a-kind investment possibilities not available to non-accredited capitalists, high returns, and enhanced diversity in your portfolio.

In certain areas, non-accredited investors also have the right to rescission (sec certification requirements). What this implies is that if a financier chooses they wish to draw out their cash early, they can claim they were a non-accredited capitalist during and obtain their cash back. However, it's never an excellent concept to supply falsified files, such as phony income tax return or monetary statements to a financial investment vehicle simply to invest, and this might bring legal problem for you down the line - can a non accredited investor invest in a startup.

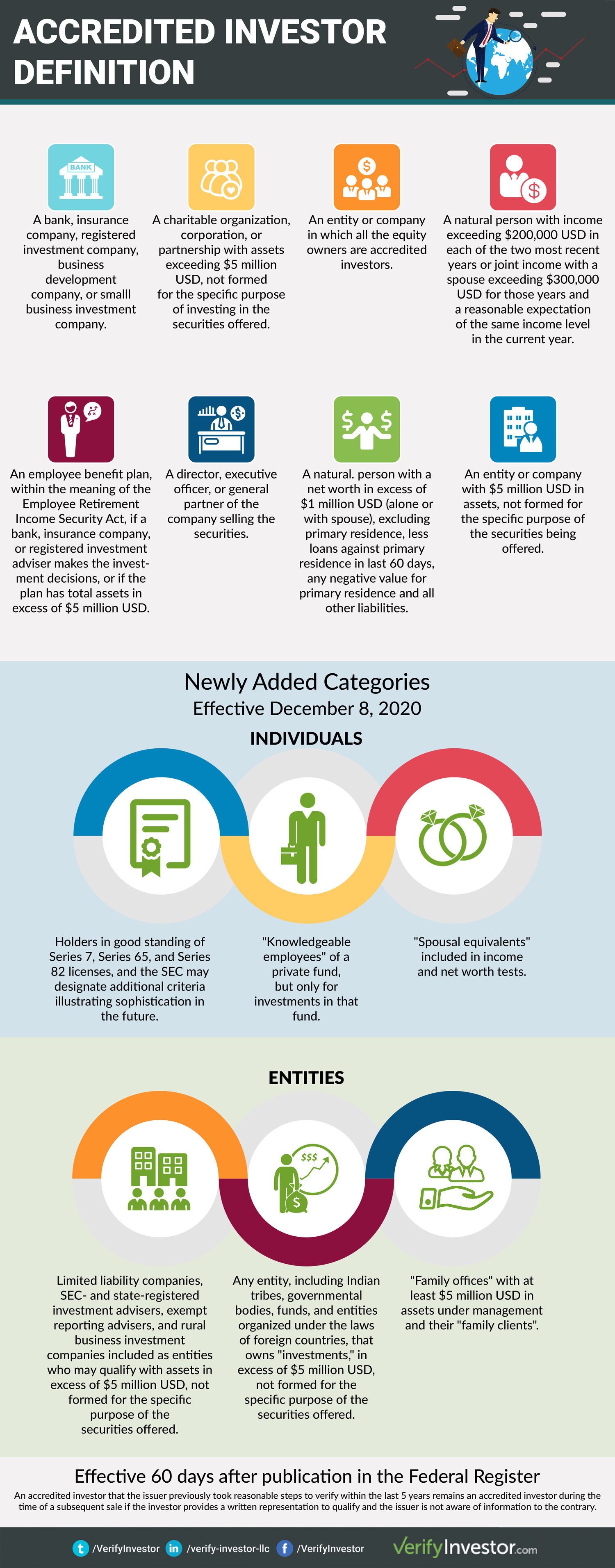

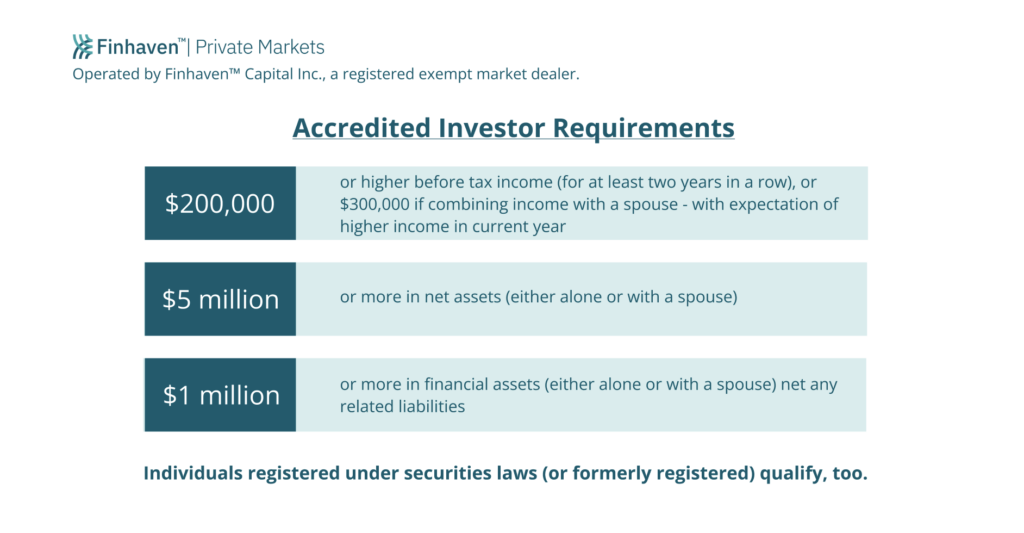

That being claimed, each bargain or each fund may have its own limitations and caps on investment quantities that they will certainly accept from a financier. Accredited investors are those that meet specific demands concerning income, credentials, or web worth.

Latest Posts

Claim Excess

Tax Delinquent Property

Taxes Foreclosure Sales