All Categories

Featured

Table of Contents

Tax lien investing can offer your portfolio exposure to actual estate all without needing to really possess residential or commercial property. Experts, however, claim the procedure is complicated and alert that amateur investors can easily get shed. Right here's whatever you require to learn about investing in a tax obligation lien certification, consisting of exactly how it works and the dangers entailed.

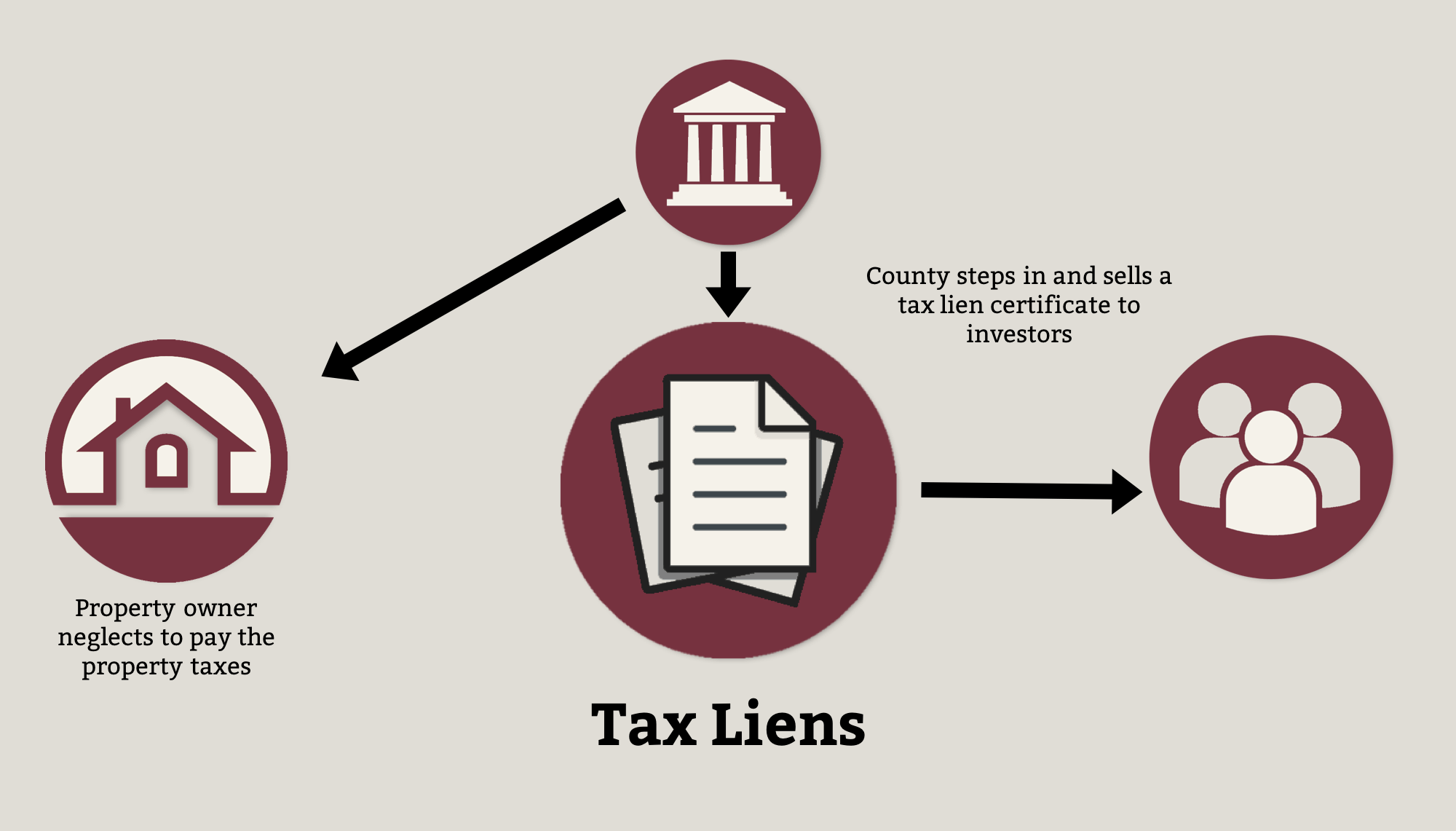

The notice commonly comes before harsher activities, such as a tax levy, where the Irs (INTERNAL REVENUE SERVICE) or local or metropolitan federal governments can in fact confiscate somebody's building to recoup the financial debt. A tax lien certificate is produced when a homeowner has actually stopped working to pay their taxes and the regional federal government problems a tax obligation lien.

Tax lien certifications are generally auctioned off to capitalists wanting to revenue. To recuperate the delinquent tax bucks, municipalities can after that sell the tax obligation lien certification to exclusive capitalists, that look after the tax bill for the right to gather that money, plus interest, from the home owners when they at some point pay back their equilibrium.

Tax Lien Investing Risks

allow for the transfer or project of overdue actual estate tax liens to the private sector, according to the National Tax Lien Organization, a not-for-profit that stands for federal governments, institutional tax lien capitalists and servicers. Here's what the procedure appears like. Tax lien capitalists need to bid for the certification in an auction, and how that procedure functions depends on the specific municipality.

Call tax obligation officials in your location to inquire exactly how those delinquent tax obligations are accumulated. The district establishes a maximum price, and the prospective buyer supplying the cheapest passion price under that optimum wins the auction.

Other winning quotes most likely to those who pay the highest money amount, or premium, above the lien quantity. What occurs following for financiers isn't something that takes place on a stock market. The winning prospective buyer needs to pay the entire tax expense, consisting of the delinquent financial obligation, rate of interest and penalties. Then, the capitalist needs to wait up until the homeowner repay their entire equilibrium unless they do not.

While some financiers can be compensated, others could be caught in the crossfire of complicated regulations and loopholes, which in the most awful of situations can cause hefty losses. From a plain profit viewpoint, most capitalists make their cash based upon the tax lien's rate of interest. Rate of interest vary and depend on the jurisdiction or the state.

Earnings, nevertheless, don't always total up to yields that high during the bidding procedure. In the end, a lot of tax obligation liens purchased at public auction are offered at rates in between 3 percent and 7 percent across the country, according to Brad Westover, executive director of the National Tax Obligation Lien Association. Prior to retiring, Richard Rampell, previously the president of Rampell & Rampell, a bookkeeping company in Palm Beach, Florida, experienced this direct.

What Does Tax Lien Investing Mean

Initially, the partners succeeded. After that big institutional financiers, including financial institutions, hedge funds and pension plan funds, went after those greater yields in auctions around the nation. The bigger capitalists assisted bid down rate of interest, so Rampell's team had not been making significant cash any longer on liens. "At the end, we weren't doing much far better than a CD," he claims - tax lien investing.

Yet that hardly ever occurs: The taxes are generally paid prior to the redemption day. Liens likewise are initial eligible payment, also prior to home loans. However, tax obligation liens have an expiry day, and a lienholder's right to confiscate on the residential property or to collect their investment runs out at the same time as the lien.

"Often it's 6 months after the redemption period," Musa says. "Do not think you can just buy and forget it." Private capitalists who are thinking about investments in tax liens should, most of all, do their research. Specialists suggest avoiding residential properties with ecological damages, such as one where a gasoline station disposed unsafe product.

Online Tax Lien Investing

"You should really recognize what you're acquiring," says Richard Zimmerman, a companion at Berdon LLP, a bookkeeping company in New york city City. "Be aware of what the residential property is, the community and worths, so you do not buy a lien that you will not be able to accumulate." Potential capitalists ought to also take a look at the property and all liens against it, in addition to current tax obligation sales and sale prices of similar homes.

Yet, maintain in mind that the information you discover can commonly be dated. "Individuals get a list of residential or commercial properties and do their due persistance weeks before a sale," Musa claims. "Fifty percent the residential or commercial properties on the list might be gone due to the fact that the taxes earn money. You're wasting your time. The closer to the date you do your due diligence, the much better.

How To Invest In Tax Liens Online

Westover says 80 percent of tax obligation lien certifications are offered to members of the NTLA, and the company can commonly compare NTLA members with the appropriate institutional financiers. That could make handling the process easier, especially for a newbie. While tax obligation lien investments can provide a charitable return, recognize the fine print, details and regulations.

"But it's made complex. You have to understand the details." Bankrate's added to an update of this story.

Property tax liens are a financial investment specific niche that is forgotten by most investors. Investing in tax obligation liens can be a profitable though fairly danger for those that are knowledgeable regarding actual estate. When people or organizations fall short to pay their real estate tax, the communities or various other federal government bodies that are owed those tax obligations position liens versus the homes.

Are Tax Liens A Safe Investment

These insurance claims on security are also traded among investors that intend to create above-average returns. With this process, the community gets its taxes and the financier gets the right to collect the amount due plus rate of interest from the debtor. The process seldom finishes with the capitalist taking ownership of the building.

Liens are offered at auctions that occasionally include bidding process battles. If you need to confiscate, there may be various other liens against the building that maintain you from occupying. If you obtain the home, there may be unpredicted expenditures such as repairs or perhaps forcing out the present occupants. You can additionally invest indirectly by means of property lien funds.

It effectively connects up the home and avoids its sale up until the owner pays the tax obligations owed or the property is taken by the creditor. For example, when a landowner or property owner falls short to pay the tax obligations on their residential or commercial property, the city or region in which the property is located has the authority to place a lien on the building.

Home with a lien attached to it can not be offered or refinanced until the tax obligations are paid and the lien is gotten rid of. When a lien is provided, a tax obligation lien certificate is created by the community that mirrors the amount owed on the property plus any type of passion or penalties due.

It's estimated that an added $328 billion of residential or commercial property taxes was analyzed across the united state in 2021. The trend proceeds. Taxes on single-family homes were approximated to rise approximately 3.6% in 2022, to an overall of $339.8 billion, and by 6.9% in 2023, to $363.3 billion. It's challenging to analyze across the country real estate tax lien numbers.

Table of Contents

Latest Posts

Claim Excess

Tax Delinquent Property

Taxes Foreclosure Sales

More

Latest Posts

Claim Excess

Tax Delinquent Property

Taxes Foreclosure Sales