All Categories

Featured

Table of Contents

In many cases, you will certainly have to outbid various other investors by using to pay a higher costs (tax liens investing). This premium is generally less than the real amount of tax obligations owed, however it depends on the financier to decide if the danger deserves the collection incentive. In most places, real estate tax are around one percent of the home's worth

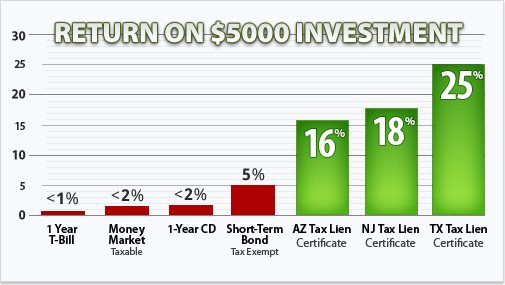

Tax lien financiers make their money on the passion repayments they accumulate when the home owner pays back the tax obligations they owe. In some places, these passion prices are as high as 18 percent, which is extra than the ordinary credit score card passion rate. Homeowner can pay what they owe simultaneously, or they can take place a layaway plan ranging from one to 3 years.

Investing In Tax Liens And Deeds

In the above example, someone with an exceptional tax obligation debt of $4k (2 years of back taxes) would certainly be providing a tax lien owner with potentially approximately $720 in rate of interest settlements, dealing with the 18 percent rate of interest we stated previously. One of the greatest benefits to tax obligation lien capitalists is the potential to get a brand-new home for their genuine estate portfolio, without needing to pay its market value.

This is a method that lots of genuine estate capitalists make use of to get undervalued buildings or distressed residential or commercial properties. And if the building owner does pay their debts, they will certainly still make a revenue in the type of interest. It's a great deal for the tax lien financier. There are some disadvantages to tax obligation lien investing.

As soon as the lien is paid, the investor has to carry on and look for a new investment. Of course, if the residential property owner is still in default, the lien holder will get the residential property, which might become a persisting income. Someone that buys a tax obligation lien might locate themselves entangled with various other liens on the property, especially if they wind up asserting the residential property on the occasion that the financial obligation goes overdue.

This can result in great deals of lawful fights, which is why it's important to work with lawyers and tax obligation advisors that recognize things like action vs title. and can aid with carrying out due diligence on a residential or commercial property. The laws around tax lien investing (and related issueslike foreclosing on tenants) are not uniform throughout states that offer investors the capability to join a tax obligation lien sale.

Offered that tax liens are frequently marketed at auction, contending bidders will certainly bid up the costs and bid down the rates of interest that can be gathered on the unpaid taxes. The champion of the public auction will certainly be the actual estate capitalist that is paying the highest premium and getting the most affordable passion price in return.

Secrets Of Tax Lien Investing

In this vein, tax obligation lien investing is a little bit much more sport-like than conventional passive means of making earnings. The first thing you'll want to do is obtain knowledgeable about the location you're considering in regards to the realty market. Bear in mind that one benefit of coming to be a lienholder is accumulating the home if the financial debt goes overdue, so you will certainly need to understand where that home is.

Once you have actually found out these information out, you require to call your local area treasurer's workplace to figure out when and where the following tax obligation lien auction is being held. These auctions are typically kept in person, however in today's day and age, several of have actually transitioned to on-line locations.

The majority of local papers release these checklists each year or semiannually. This can give you an excellent idea concerning upcoming opportunities. Keep in mind that residential or commercial property tax obligations are generally one percent of the property value, but overdue taxes accumulating over a number of years could be a more substantial quantity. You can leverage your own money reserves or check out choices like realty crowdfunding to obtain the capital you need.

What Does Tax Lien Investing Mean

it has actually the added perk of acquiring the residential or commercial property if the financial obligation remains unpaid. While it can be a lucrative possibility for the investor, it does call for some critical footwork. Occupants and residential property proprietors do have legal defenses that make tax obligation lien investing a more involved procedure than simply bidding to purchase a debt and waiting to gather the settlement.

Purchasing tax obligation liens involves acquiring a legal insurance claim on a home as a result of unsettled property tax obligations. This approach of investing has actually gained popularity as a result of its potential for high returns with fairly reduced first funding. Tax liens are generally offered at auctions, and the process can vary depending upon the area.

Capitalists look for tax obligation liens for several factors: 1. Reduced Preliminary Investment: Tax lien investing commonly requires a small amount of money to start, making it easily accessible to a wide range of capitalists. Some tax liens can be acquired for as little as a few hundred bucks. 2. High Returns: The rate of interest on tax liens can be dramatically greater than standard financial investment returns.

Investing Tax Liens

Residential or commercial property Acquisition: If the building proprietor falls short to pay the overdue tax obligations and interest within the redemption duration, the financier may have the right to confiscate and obtain the property. When financiers buy a tax lien, they pay the overdue taxes on a building and obtain a tax obligation lien certification.

Payment by the Building Owner: The building proprietor settles the past due tax obligations plus rate of interest within a given duration, and the financier gets the payment with passion. Repossession: If the home proprietor does not repay the tax obligations within the redemption period, the investor can launch repossession proceedings to get the building.

The self-directed individual retirement account purchases the lien certificate and pays linked costs. Mean the homeowner pays off the lien, and the proceeds go back to the individual retirement account. If the residential or commercial property is confiscated and offered, the sale proceeds likewise return to the IRA, potentially expanding the retirement cost savings. Tax Lien: The federal government offers a lien on the residential or commercial property as a result of overdue taxes.

Best Tax Lien States For Investing

Tax Act: The federal government offers the actual act to the property at public auction. According to the National Tax Obligation Lien Association (NTLA), 36 states and 2,500 territories within the US enable for the sale of tax liens, while just 31 states permit tax action sales.

Latest Posts

Claim Excess

Tax Delinquent Property

Taxes Foreclosure Sales