All Categories

Featured

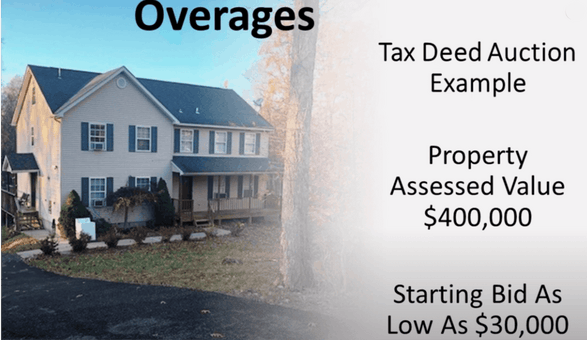

Tax Obligation Sale Overages Tax Obligation Auction Overages Before the choice by the Court, Michigan was among a minority of states that permitted the retention of excess make money from tax-foreclosure sales. Residential or industrial homeowner that have in fact lost their residential property as an outcome of a tax obligation foreclosure sale currently have a case versus the area for the difference in between the amount of tax commitments owed and the quantity understood at the tax responsibility sale by the Region.

In the past, miss out on mapping was done by financial debt collector and private investigators to locate individuals that where staying clear of a debt, under examination, or in problem with the regulations.

Below is a checklist of one of the most common client inquiries. If you can't discover a solution to your inquiry, please do not wait to connect to us. Who is called for to file tax obligation overages manual pdf? All individuals that are needed to submit a government earnings tax obligation return are likewise needed to file a tax excess manual.

Depending on their declaring standing and earnings degree, some people might be called for to file a state revenue tax return too. The manual can be discovered on the Internal Income Service (INTERNAL REVENUE SERVICE) website. Just how to fill in tax excess hands-on pdf? 1. tax owed property sale. Download and install the pertinent PDF form for filing your tax obligations.

Complying with the guidelines on the kind, load out all the areas that are relevant to your tax circumstance. When you come to the area on filing for tax overages, make certain to provide all the information called for.

4. When you have finished the kind, see to it to double check it for precision prior to sending it. 5. Send the kind to the appropriate tax obligation authority. You will usually need to mail it in or submit it online. What is tax overages hands-on pdf? A tax obligation overages hands-on PDF is a record or guide that supplies details and instructions on how to discover, collect, and insurance claim tax obligation overages.

Buying Tax Foreclosure Properties

The excess quantity is commonly refunded to the proprietor, and the handbook provides support on the procedure and treatments entailed in declaring these refunds. What is the purpose of tax obligation overages hand-operated pdf? The objective of a tax overages hand-operated PDF is to offer info and support pertaining to tax excess.

2. Tax obligation Year: The particular year for which the overage is being reported. 3. Amount of Overpayment: The overall amount of overpayment or excess tax obligation paid by the taxpayer. 4. Resource of Overpayment: The factor or source of the overpayment, such as excess tax withholding, approximated tax settlements, or any kind of various other appropriate source.

Excess Proceeds Texas

Reimbursement Request: If the taxpayer is asking for a reimbursement of the overpayment, they need to indicate the amount to be refunded and the preferred technique of reimbursement (e.g., straight down payment, paper check). 6. Supporting Records: Any kind of appropriate sustaining papers, such as W-2 types, 1099 forms, or various other tax-related receipts, that verify the overpayment and validate the reimbursement request.

Signature and Day: The taxpayer needs to authorize and date the document to accredit the precision of the information offered. It is very important to note that this information is common and may not cover all the particular demands or variants in different areas. Always consult the pertinent tax authorities or speak with a tax obligation specialist for precise and current information concerning tax overages reporting.

Latest Posts

Claim Excess

Tax Delinquent Property

Taxes Foreclosure Sales